- Remove tax-free equity from your house with Retirement Advantage Equity Release

- No monthly payments

- No lenders fees

- No product fees

- Use the cash to pay off loans and credit cards

- Continue to stay in your house.

- 5.01% APRC fixed for life

- Free valuation

How much can I borrow?

You can get 65% of your property’s valuation. For example, if your house is worth £290,000 you can borrow £188,000.

Does Retirement Advantage offer Pensioner Mortgages?

Yes, Retirement Advantage Pensioner Mortgages are 2.64% APRC.

Individuals often seek out a lifetime mortgage with flexible drawdown cash release, interest-only lifetime mortgages, or lump sum lifetime mortgages. However, Legal and General, like Old Mutual Wealth, are keen to see paperwork to show your personal situation in the form of pension statements.

Lenders for UK Equity Release

- the Telegraph

- Santander

- Key Retirement

Applications of Equity Release Schemes

It is often used to help with tax planning, and interest rates can be quite low. Low rates help families buy their own homes or pay off their debts, like loans and credit cards, so they have more monthly disposable income.

Equity Release LTV Percentages

- 55% monthly payment lifetime mortgage Zurich

- 40% loan to value (LTV) lump sum lifetime mortgages Pepper

- 30% LTV home reversion schemes Step One Finance

Do Retirement Advantage do Retirement Mortgages?

Yes, Retirement Advantage Retirement Mortgages are 2.64% APRC.

The 1st and 2nd charge lenders will want to know if the property is a semi-detached freehold house or a Leasehold flat with a share of freehold and if the resident is a Private Tenant.

UK Equity Release Lenders, as well as Retirement Advantage Equity Release

It is common to find people seeking out interest-only lifetime mortgages, lump sum lifetime mortgages, or home reversion plans. However, Bower, like Aegon, is eager to see evidence of your circumstances in the form of bank statements.

- Aviva Lifetime Mortgages

- Bridgewater Lifetime Mortgage

- Stonehaven Equity Release

- Retirement Advantage Equity Release

- Royal Bank of Scotland Interest Only Lifetime Mortgage

- More2Life Capital Choice Plan

- Bridgewater Lifetime Mortgage

- Canada Life Lifestyle Gold Flexi

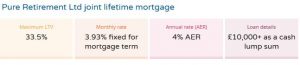

- Pure Retirement Classic Voluntary Payment Super Lite

- HSBC Interest Only Lifetime Mortgage

- Lloyds Bank Equity Release Schemes

- Bridgewater Equity Release

- Hodge Equity Release Plans

- L&G Legal & General Flexible Lifetime Mortgage

- Nationwide Interest Only Lifetime Mortgage

- Lifetime Interest-Only Mortgage

- Barclays Equity Release

- NatWest Interest Only Lifetime Mortgage

- More to Life Capital Choice Plus Plan

Telephone:

Does Retirement Advantage offer Equity Release Under 55?

Yes, Retirement Advantage Equity Release Under 55 is 2.64% APR.

Disadvantages of Retirement Advantage Equity Release Plans

A monthly payment lifetime mortgage can reduce your estate value. A monthly payment lifetime mortgage may impact entitlements to state benefits. You may need to pay an advisor’s fee, and some products may expose you to changes in interest rates.

Equity Release percentages of your current property value

The older you are and the more illnesses you have, the more cash you can release.

- Zurich Equity Release Deals

- Yorkshire Bank Equity Release Advisor

- Canada Life Lifetime Mortgages

- Legal And General Equity Release

- Under 55 Equity Release Reviews

- Canada Life Interest Only Lifetime Mortgages

- Lifetime Mortgage Crown

- Lv= Equity Release Schemes

- Hodge Lifetime Equity Release

- Norwich Union Interest Only Lifetime Mortgages

- Yorkshire Building Society Equity Release Deals

- Lloyds Equity Release Advisor

- HSBC Lump Sum Lifetime Mortgages

- Just Retirement Home Reversion Plans

- Aviva Lifetime Mortgages

- Marsden Mortgages

- Home Reversion Plans

- Age Partnership Lump Sum Lifetime Mortgages

- Lloyds Bank Lump Sum Lifetime Mortgages

- Lv Drawdown Lifetime Mortgage

- Lifetime Mortgages More to Life

- Retirement Advantage Lump Sum Lifetime Mortgages

- L&G Interest Only Lifetime Mortgages

- One Family Lifetime Mortgages

- Equity Release Scottish Building Society

- 55 Mortgage

- Equity Release RBS

- Lifetime Mortgages Key Retirement Solutions

https://www.canadalife.co.uk/home-finance/lifetime-mortgages/

Does Retirement Advantage offer Lifetime Mortgages?

Yes, Retirement Advantage does lifetime mortgages at 2.64% MER.

Retirement Advantage, known for its equity release products, has been rebranded as Canada Life. Despite the change in branding, the essence of the products and services offered continues to focus on providing financial solutions for older homeowners. These include a range of mortgages tailored to those at or approaching retirement age, offering them ways to release equity from their properties while remaining in their homes.

Retirement Advantage Rates and Interest Rates

The interest rates offered by the firm, now under the Canada Life brand, remain a critical factor for customers considering equity release. These rates determine the cost of the loan over time and are a key consideration in the decision-making process. The competitive retirement advantage rates are designed to be attractive to those on fixed retirement incomes, ensuring that the products are both accessible and financially manageable in the long term.

Retirement Advantage Equity Release Calculator

The Retirement Advantage Equity Release Calculator is an essential tool for those exploring the equity release option. It allows potential customers to estimate the amount of equity they could release from their homes, providing a crucial starting point for financial planning in retirement.

Retirement Advantage Mortgages for the Over 50s

The firm has carved out a niche in providing retirement advantage Mortgages Over 50, understanding that this demographic’s financial needs and goals can differ significantly from those of younger homeowners. These products are designed flexibly to accommodate the various financial scenarios faced by those in this age bracket.

Retirement Advantage RIO Mortgages

The retirement advantage RIO (Retirement Interest Only) Mortgages were particularly popular among homeowners over 55. They allowed them to service just the interest on their loan for as long as they remained in their home. The loan is repaid when the property is sold, balancing affordability and equity retention.

Interest Only Mortgages and Pensioner Mortgages

In addition to RIO mortgages, Retirement Advantage also offers Interest-Only Mortgages and Pensioner Mortgages. These products aimed to provide pensioners with mortgage options, considering the potential for limited income streams during retirement.

Retirement Mortgages for Different Age Groups

The suite of products extended to cover various age milestones, including retirement advantage Mortgages over 55, Mortgages Over 60, mortgages over 65, mortgages over 70, and mortgages over 75. These products were designed to cater to the financial circumstances typically associated with each age group, offering tailored solutions to each.

Retirement Advantage Later Life Mortgages

Later Life Mortgages were part of the product line that offered additional financial options for those in later life stages. Customers could use their property to support their retirement lifestyle, fund care costs, or provide financial assistance to family members.

Retirement Advantage Remortgage Options

For those over 60 looking to remortgage, retirement advantage provides Remortgage over 60 options, allowing individuals to potentially secure more favourable terms or release additional equity from their homes.

Inclusive Lending Practices

The company was noted for its inclusive lending practices, which included no upper age limit on its mortgage products. This policy particularly benefited older borrowers, offering an inclusive approach to those in the 50-plus, 55-plus, 60-plus, 65-plus, and 75-plus age brackets.

Special Considerations for Older Borrowers

For older borrowers who may have faced challenges with credit in the past, retirement advantage had measures in place that could accommodate those with a bad credit history or those looking for products that may not require a credit check.

Seeking Professional Advice

Retirement Advantage always emphasised the importance of seeking professional advice, in line with guidance from experts like Martin Lewis, the Money Saving Expert. The firm advised consulting with a qualified broker or advisor to ensure customers make informed decisions that best suit their circumstances.

Customer Experiences and Reviews

Customer reviews of retirement advantage products typically highlighted the company’s understanding of the unique needs of older homeowners. Clients often praised the clear communication and comprehensive advice the firm’s advisors provided, noting that it helped them navigate the complexities of equity release.

While some customers noted the long-term financial implications of equity release as a concern, particularly about interest accumulation and inheritance considerations, many expressed satisfaction with the financial freedom and peace of mind the products afforded them.

Although retirement advantage as a brand has transitioned to Canada Life, the legacy of its equity release products continues to influence the offerings available to older homeowners today. The rebranded company is committed to providing financial solutions that cater to the needs of those in retirement, ensuring that the ethos of retirement advantage lives on in the current product offerings.