Find out if a remortgage over 70 from Stonehearth Finance could be the solution for your retirement.

- Mortgages for the over 70s at 4.75% fixed for life

- No lender, broker or advisor fees

- Free home valuation

- Ideal to pay off an existing mortgage that has come to the end of its term

- Loan-to-value up to 70% when you can make mortgage repayments

- There are no valuation penalties for flats and other leasehold property titles.

- Release equity for gifting or IHT planning

- No early repayment fees

- A portable mortgage so you can move house

- You can get further advances with no fees, subject to valuation

- Some options with no monthly repayments

- Up to 2 penalty-free payment holidays per year

- No upper mortgage age limit

If your home is valued at £215,000 and you have a 70% loan-to-value, you can release up to £150,500.

Interest Only Mortgages for over 70s UK Interest Rates For 2026

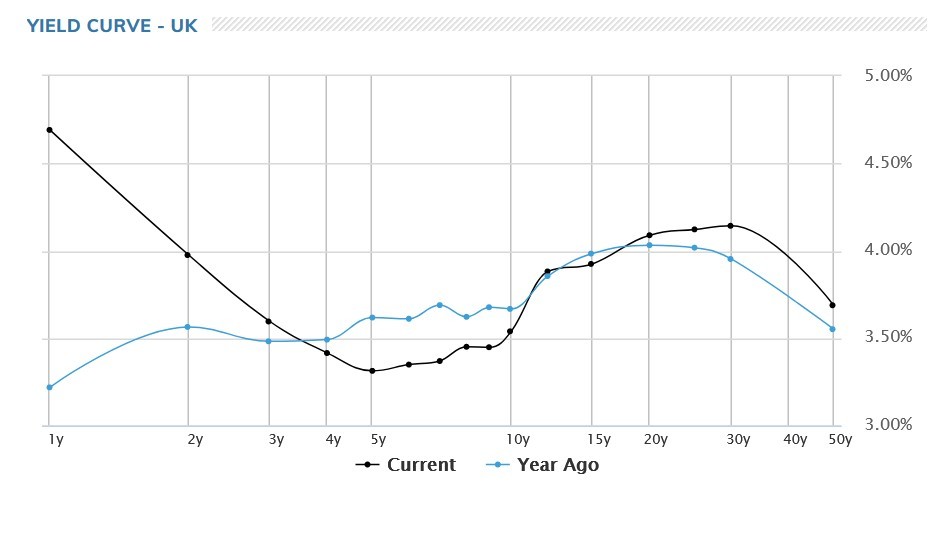

UK mortgage rates are often set based on the most relevant part of the UK gilt market yield curve. For later-life lending, that is usually the 10-year gilt or the 15-year gilt. Lending money to the UK government is seen as virtually risk-free.

So, lending money against UK property is riskier than this, but it remains a shallow risk given the stability of the UK property market.

Pensioner Remortgage over 70 Calculator

A remortgage with a monthly payment can be a better option for equity release. The Equity Release Council like to force lenders to offer people an opportunity to make some payments.

The Stonehearth calculator will tell you how much you can borrow based on the total open market value of your property and the fixed interest rate of 4.89%, which is the monthly payment.

Stonehearth’s advantage is that it can offer a high loan-to-value mortgage to people with leasehold flats and other leasehold properties without applying a haircut to the valuation.

Retirement Interest-Only Mortgage For The Over 70s

Like Stonehearth, Nationwide mortgages for the over-70s have some very competitive rates, similar to those offered to working-age people.

Pensioner Over 70 Mortgages Fixed Rates

With Stonehearth Pensioner Over 70 Mortgages, the fixed rates are meagre, and you have the flexibility of up to 2 penalty-free payment holidays per year. The only requirement is to give Stonehearth at least 10 working days’ notice for the payment holiday so the payment is not collected by direct debit.

RIO Mortgage For Over 70s Rates

For mortgage lenders, three significant interest rates are the Bank of England base rate, the three-month LIBOR rate in pounds, and the 10-year gilt rate.

What is the three-month GBP LIBOR interest rate?

The 3-month GBP LIBOR interest rate is the average interest rate at which a selection of banks in London is prepared/considered ready to lend to one another in British pound sterling with a maturity of 3 months, alongside the 3-month GBP LIBOR interest rate.

Many banks use LIBOR as the base rate when setting interest rates on savings, mortgages, and loans.

Alternatives To Later Life Mortgages Over 70 – mortgage providers

You could consider equity release if you can’t afford a monthly payment. Lifetime mortgages or home reversion plans are mortgage products not usually offered by high street lenders. The problem with a retirement mortgage is the affordability checks, age limits, mortgage payments, and having a good credit score.

- Aviva equity release

- Nationwide pensioner mortgages

- Halifax lifetime mortgage

- LV mortgage term

- One Family retirement interest-only mortgages

- Canada Life interest-only mortgage

- Yorkshire Bank mortgage deals

- More To Life mortgage options

- Lloyds Bank ownership scheme

- Yorkshire Building Society interest rate

- Zurich equity release schemes

- Hodge retirement age

- Crown equity release interest rate

- Age Partnership mortgage broker

- Legal And General maximum age

- RBS mortgage adviser home reversion plan

- Scottish Building Society mortgage over 70

- Marsden Building Society lending criteria

- Lump sum mortgages for over 60s

- Key eligibility criteria mortgage over 70

- NatWest maximum age limit with high loan amounts

- Nottingham Building Society mortgages for home improvements

- Leeds Building Society mortgage offer

- Building Societies Equity Release Scheme

- The Family Building Society older borrowers loans

- Standard mortgages for people 70 years old

- Mortgage providers for buy-to-let mortgages with low interest payments

Fees And Other Costs Involved in Mortgages For Pensioners Over 70

With Stonehearth, there are no broker, product, or lender fees and a free valuation. The only fee you have to pay is for your solicitor.

Because of the pensioner’s stable income, a retired person can access the lowest rates, as the lender’s risk is very low.

The mortgage advice bureau could help you determine the best lender.

Example Mortgages For The Over 70s – borrowing options and pensioner loans

After his free valuation, Mr A’s home is worth £415,000. As he had an excellent pension income, he could borrow £290,500 at a low fixed rate of 4.89%. He had to make a monthly interest payment of £2154.54. Stonehearth Finance is a mortgage lender offering a mortgage deal that accepts rental income, with no product fee and no age limits.

You can use this type of mortgage to pay off credit cards and other borrowing.

Retirement Interest-Only (RIO) mortgages for 25 years are increasingly popular among UK retirees. They offer a way to release equity from their homes while allowing them to stay in the property.

RIO mortgages are aimed at older borrowers, typically over 55 or 60, and offer an alternative to traditional equity release schemes or standard mortgages. They work by allowing the borrower to pay only the interest on the loan each month, with the capital repayment due when the property is sold, the borrower dies, or moves into long-term care.

Unlike standard interest-only mortgages, 15-year RIO loans do not have a set end date. This is particularly advantageous for older individuals aged 70 or over who may not have a regular income post-retirement but have substantial home equity. The interest rates for RIO mortgages can be fixed or variable, with the former offering the security of knowing exactly how much will be paid each month.

One significant benefit of a RIO mortgage for people over 80 is that it can help retirees manage their finances more effectively by reducing their monthly outgoings. As they are not required to repay the capital until a later date, they can use the released equity for various purposes, such as supplementing retirement income, home improvements, or providing financial help to family members.

The homeowner only pays the interest—even if they are age 85 or over—so the borrowed amount will not decrease over time. This means the equity remaining in the property for the homeowner’s beneficiaries will be reduced, which could affect inheritance planning. Borrowers must also pass affordability checks to meet the interest payments throughout retirement.

The Financial Conduct Authority (FCA) regulates RIO mortgages and eligibility requirements. To ensure the borrower’s ability to sustain the loan, the FCA requires a robust assessment of their income and expenses.

This safeguard prevents retirees from becoming financially overstretched. Furthermore, borrowers are protected under the FCA’s Mortgage Conduct of Business (MCOB) rules, which require lenders to treat customers fairly and consider their needs and circumstances.

Potential borrowers must seek independent financial advice or a credit broker to understand the full implications of an RIO mortgage or retirement remortgage and how it fits into their overall retirement planning. They should compare different products, consider the impact on their estate, and understand the specific terms and conditions of the mortgage.

RIO mortgages offer a flexible solution for many retirees, allowing them to leverage the equity in their homes while maintaining the lifestyle they are accustomed to in retirement. However, they are not without risks and costs, and careful consideration is needed to ensure they are the right choice for the individual’s circumstances and long-term financial health. Professional advice is strongly recommended for any financial decision, especially retirement and housing.

Stonehearth Finance’s fixed-rate mortgage and lifetime mortgage are authorised and regulated by the Prudential Regulation Authority and the Financial Conduct Authority (Financial Services Register number: 204503).

Registered Office: Apex Plaza, Forbury Road, Reading, RG1 1AX. Registered in England. Company No. 947662.

Asset Finance lending and equity release schemes for people at the right retirement age can be easy to obtain in 2026, as an exemption under the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 applies, and the schemes are exempt from regulation by the Financial Conduct Authority or Prudential Regulation Authority.