- Remove tax-free money from your home with Pure Retirement Equity Release

- There is no need to make monthly payments unless you want to pay interest-only payments.

- Help your family with the equity you release

- Still, have a few more mortgage payments to make? We can help with that.

- Continue to stay in your home for as long as you like

- It can be used for buy-to-let properties.

Fixed rates 5.07% for the life of the equity release.

How much cash can I borrow?

You can achieve 60% of your home’s valuation. For example, if your home is worth £220,000, you can release £132,000.

It is expected to find individuals looking for monthly payment equity release, lifetime mortgage with flexible drawdown cash release or lifetime mortgage with compliant cash release. However, Age Partnership like LV Liverpool Victoria is keen to see evidence of your circumstances through bank statements.

UK Pure Equity Release Scheme Lenders

Uses of pure retirement equity release Schemes

Often used to help tax planning and interest rates can be attractive. Help your family get a deposit for their own home or pay down your debts so that you can spend more of your monthly income.

Retirement Advantage Equity Release percentages of your current property value

- 50% monthly payment lifetime mortgage Legal & General

- 50% loan to value (LTV) lump sum lifetime mortgages Lifetime Mortgage from L&G

The 1st and 2nd charge lenders will want to know if the property is a Freehold terraced or Leasehold house and if the resident is an Owner Occupier Primary Residence.

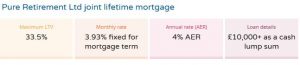

Does Pure Retirement offer Equity Release?

Yes, Pure Retirement Equity Release is 1.97% APRC.

UK Equity Release Scheme Providers

It’s usual to find individuals looking for lifetime mortgages with flexible drawdown cash release, lump sum lifetime mortgages, or lifetime mortgages with adjustable drawdown cash release. However, Legal and General, like Old Mutual Wealth, seek proof of your circumstances through bank statements.

- Canada Life Lifetime Mortgage

- Liverpool Victoria LV= Flexible Lifetime Mortgage

- More2Life Capital Choice Plus Plan

- Lloyds Bank Equity Release

- Royal Bank of Scotland Equity Release Plans

- Aviva Equity Release Schemes

- More to Life Tailored Choice Plan

- Hodge Lifetime Mortgage Flexible Drawdown Plan

- HSBC Equity Release

- Lifetime Mortgage

- Royal Bank of Scotland Interest Only Lifetime Mortgage

- Aviva Lifetime Mortgage

- L&G Legal & General Flexible Lifetime Mortgage

- More to Life Flexi Choice Drawdown Lite Plan

Telephone:

Does Pure Retirement offer Pensioner Mortgages?

Yes, Pure Retirement Pensioner Mortgages are 1.97% MER.

Does Pure Retirement offer Retirement Mortgages?

Yes, Pure Retirement Retirement Mortgages are 1.97% APRC.

Pitfalls of Lifetime Mortgages

A lifetime mortgage with a flexible drawdown cash release can reduce the value of your estate. A lifetime mortgage with a compliant drawdown cash release may impact the ability to get state benefits. You may need to pay a valuation fee, and you could be exposed to changes in interest rates with some products.

How much is expected to be released from the home with Pure retirement equity release?

The elderly and unhealthier you are, the more tax-free money you can release with pure retirement equity release.

- Telegraph Interest Only Lifetime Mortgages

- Key Retirement Solutions Home Reversion Plans

- Canada Life Equity Release Advisor

- Yorkshire Bank Lifetime Mortgages

- Equity Release Royal Bank Of Scotland

- Lv= Equity Release Reviews

- Yorkshire Building Society Equity Release Deals

- Norwich Union Lifetime Mortgage

- Lifetime Mortgage Canada Life

- Lifetime Mortgages Aviva

- HSBC Equity Release

- Scottish Building Society Equity Release Plans

- Lifetime Mortgages Lloyds Bank

- Bridgewater Equity Release

- Lv Equity Release Deals

- Age Partnership Equity Release Calculator

- Equity Release

- Equity Release Mortgage Under 55

- Lifetime Mortgages Hodge

- Crown Lifetime Mortgages

- One Family Lifetime Mortgage

- Just Retirement Home Reversion Plans

- Zurich Lump Sum Lifetime Mortgages

- Halifax Interest Only Lifetime Mortgages

- Equity Release L&G

- NatWest Equity Release Reviews

- Retirement Advantage Home Reversion Plans

- Marsden Building Society Home Reversion Plans

Does Pure Retirement offer Equity Release Under 55?

Yes, Pure Retirement Equity Release Under 55 is 1.97% MER.

Pure Retirement Equity Release Products

- Pure Retirement – Classic Super Lite Plan

- Pure Retirement – Classic Lite

- Pure Retirement – Max Drawdown Plan

3175 Century Way, Leeds, LS15 8ZB

Does Pure Retirement do Lifetime Mortgages?

Yes, Pure Retirement does lifetime mortgages at 1.97% APRC.

Pure Equity Release for a pensioner interest only mortgage

In the realm of UK financial services, Pure Equity Release is a prominent avenue for those seeking to unlock the latent value of their homes without the burden of monthly mortgage repayments. This financial product caters to homeowners aged 55 and above, allowing them to access tax-free cash from their property’s equity while retaining full ownership and occupancy rights. It essentially converts a portion of the property’s value into a lump sum or regular income, offering financial flexibility during retirement.

In this context, Pure mortgages typically refer to standard residential mortgages in the UK. These traditional mortgages involve regular repayments, including interest and principal, serving as the cornerstone of property ownership. In contrast, Pure Equity Release is tailored for retirees who have paid off their original mortgages or have substantial home equity.

Interest-only mortgage rates in 2025 continue to be influenced by broader economic conditions, including the Bank of England’s base rate. Potential borrowers must assess the prevailing market rates, lender offers, and financial situation. Rates can fluctuate, impacting the cost of borrowing for those opting for interest-only mortgages.

In retirement planning, Pure Retirement is a recognized provider of retirement financial solutions, offering products such as equity release and lifetime mortgages. These financial tools are designed to help individuals secure their financial future and ensure that they can enjoy a comfortable retirement in the UK.

In conclusion, UK Pure Equity Release, Pure Mortgages, and retirement planning remain crucial aspects of the financial services landscape. Monitoring interest-only mortgage rates in 2025 is vital for those considering this option to make informed financial decisions.

Pure retirement reviews for a pure mortgage

Pure Retirement, a company specialising in equity release, has garnered attention in the UK financial sector for its range of products tailored to the older demographic, particularly retirement ones. The company’s focus on equity release plans, which allow individuals to access the equity tied up in their homes while continuing to live there, positions it uniquely in the market.

Customer reviews often highlight the company’s transparent and customer-centric approach. Many clients appreciate the clarity with which Pure Retirement explains the nuances of equity release, a complex financial product that can be challenging to navigate. This transparency is crucial in building trust, especially when dealing with the significant economic decisions accompanying retirement planning.

However, it’s important to note that reviews also reflect diverse experiences. Some customers have expressed concerns over the long-term financial implications of equity release, particularly about interest rates and the impact on their estate’s value. This is a common concern in the equity release sector and not unique to Pure Retirement.

Advisors associated with Pure Retirement frequently receive commendation for their professionalism and knowledge. They are often described as empathetic and patient, understanding the emotional and financial weight of their clients’ decisions. This level of service is essential in the equity release market, where decisions have long-term consequences and require a deep understanding of individual circumstances.

The company’s digital presence and ease of access to information also received positive remarks. The website and customer service channels are noted for being user-friendly, a significant factor for an older demographic that might not be as tech-savvy.

Potential clients must consider the positive aspects and the concerns raised in these reviews. Equity release is a significant financial decision, and the varied experiences of Pure Retirement’s customers highlight the importance of personalised advice and a thorough understanding of the product’s long-term implications.