- Release equity from your house with Hodge Lifetime Equity Release

- Suitable for UK homeowners under 55 and under 55 years old

- No need to make monthly payments

- Help a family member buy their own home with a modest mortgage

- Continue to stay in your property for as long as you like

- 5.05% Fixed for life

- Free home valuation

- No product fees

- No lenders fees

How much can I get?

You can achieve 65% of your property’s valuation. For example, if your home is worth £290,000 you can get £188,000.

Hodge lifetime reviews

Do Hodge Lifetime do Lifetime Mortgages?

Yes, Hodge Lifetime does lifetime mortgages at 2.14% MER.

Hodge mortgages

Does Hodge Lifetime do Equity Release Under 55?

Yes, Hodge Lifetime Equity Release Under 55 is 2.14% APRC.

It is usual to encounter people seeking monthly payment lifetime mortgages, interest-only lifetime mortgages or home reversion plans. However, Lifetime mortgages from L&G, like AA equity release, are keen to see evidence of your circumstances in bank statements.

UK Equity Release Scheme Lenders similar to Hodge Equity Release

- Bower

- Pure Retirement

- Age Partnership

- Stonehaven

Advantages of Equity Release Plans – Use Hodge Bank reviews

It could be used to optimise tax planning, and interest rates are attractive. Help a family member buy their own home with a smaller mortgage or pay down your credit cards and loans so you have lower monthly outgoings.

Does Hodge Lifetime offer Retirement Mortgages?

Yes, Hodge Lifetime Retirement Mortgages are 2.14% MER.

What percentage can be released?

- 60% monthly payment lifetime mortgage VitalityLife Equity Release

- 60% loan to value interest-only lifetime mortgages Key Retirement

- 45% loan to value (LTV) monthly payment lifetime mortgage Prudential Lifetime

- 60% loan to value home reversion plans Norton Finance

- 25% loan to value (LTV) lumpsum lifetime mortgages Yorkshire Building Society

The mortgage lender will want to know if the property is a Freehold terraced house or a Leasehold flat with a share of freehold and if the resident is an Assured shorthold tenancy tenant.

Does Hodge Lifetime offer Pensioner Mortgages?

Yes, Hodge Lifetime Pensioner Mortgages are 2.14% MER.

Equity Release Scheme Lenders like a Hodge lifetime mortgage

It is usual to encounter individuals seeking out lump sum lifetime mortgages, monthly payment lifetime mortgage or home reversion schemes, however, Aviva like Zurich are eager to see evidence of your circumstances in the form of pension statements.

Does Hodge offer Equity Release?

Yes, Hodge Equity Release is 2.14% APRC.

- Aviva Lifestyle Flexible Option

- Canada Life Equity Release Schemes

- Hodge Equity Release Plans for UK Retirees

- L&G Legal & General Flexi Max Voluntary Repayment Plan

- Liverpool Victoria LV Equity Release Schemes

- Pure Retirement Drawdown Plan

- Stonehaven Interest Select Plan

- Royal Bank of Scotland Equity Release

- Aviva Equity Release

- More2Life Capital Choice Plus Plan

- Just Retirement Equity Release Schemes

- More to Life Capital Choice Plan

- Pure Retirement Lifetime Mortgage

- Hodge Equity Release

- Hodge Indexed Lifetime Mortgage

- More to Life Capital Choice Plan

- HSBC Equity Release Plans

- Lloyds Bank Equity Release Schemes

- Equity Release Plans

- Barclays Interest Only Lifetime Mortgage

- Age Partnership Lifetime Mortgage

- Aviva Equity Release Schemes

- NatWest Interest Only Lifetime Mortgage

- More to Life Flexi Choice Drawdown Lite Plan

Does Hodge Lifetime offer Equity Release?

Yes, Hodge Lifetime Equity Release is 2.14% MER.

Telephone:

Does Hodge offer Pensioner Mortgages?

Yes, Hodge Pensioner Mortgages are 2.14% APR.

Drawbacks of Hodge’s lifetime equity release

Hodge Equity Release plans can reduce the inheritance for your family. Hodge lifetime equity release may impact the ability to claim entitlements. You may need to pay a legal fee, and you could have higher rates to pay with some schemes.

What percentage can be released – Hodge lifetime equity release?

The older you are and the more illnesses you have, the more tax-free cash you can release with Hodge lifetime equity release.

Does Hodge do Retirement Mortgages?

Yes, Hodge Retirement Mortgages are 2.14% APRC.

- Lifetime Mortgages Lloyds

- Royal Bank Of Scotland Equity Release Interest Rates

- Marsden Building Society Lifetime Mortgages

- Lifetime Mortgage Santander

- Lifetime Mortgage Aviva

- Hodge Life

- Age Partnership

- Crown Home Reversion Plans

- Lv Interest Only Lifetime Mortgages

- Interest Only Mortgage

- Halifax Equity Release

- Under 55 Drawdown Lifetime Mortgage

- Canada Life Lifetime Mortgage

- Bridgewater Lifetime Mortgages

- Natwest Interest Only Lifetime Mortgages

- Pure Retirement Equity Release Interest Rates

- Zurich Equity Release Reviews

- Retirement Advantage Equity Release Schemes

- Lifetime Mortgage Rbs

- Equity Release Yorkshire Building Society

- L&G Home Reversion Plans

- Telegraph Lifetime Mortgage

- Canada Life Equity Release Plans

- More to Life Interest Only Lifetime Mortgages

- Lve Equity Release Plans

- Equity Release One Family

- Legal And General Equity Release Rates

- More to Life Equity Release Interest Rates

- Scottish Building Society Equity Release Deals

- Equity Release Mortgage Under 55

- Norwich Union Lump Sum Lifetime Mortgages

- Lloyds Bank Lifetime Mortgage

Does Hodge do Equity Release Under 55?

Yes, Hodge Equity Release Under 55 is 2.14% APRC.

Does Hodge offer Lifetime Mortgages?

Yes, Hodge does lifetime mortgages at 2.14% APRC.

Equity release plans, such as those offered by Hodge Lifetime, have become significant financial products for homeowners in their later years. These instruments allow individuals, typically over the age of 55, to access the equity tied up in their homes without the need to move or sell their property. Hodge Lifetime has been a notable provider in this sector, offering a range of products tailored to older homeowners’ financial needs.

Hodge Lifetime Equity Release Products

Hodge Lifetime’s suite of equity release products includes various types of plans, such as lump sum mortgages, drawdown plans, and interest-only options, each designed to provide homeowners with flexibility and security. Their products often cater to individuals in different age brackets, with specific mortgages tailored for those over 50, 55, 60, 65, 70, and even over 75.

Hodge RIO Mortgages

Hodge’s Retirement Interest-Only (RIO) mortgages are a particular kind of loan in which the borrower pays the interest monthly; hence, the principal amount remains unchanged. This type of mortgage can be favourable for those with a reliable source of income during retirement and who wish to maintain the capital in their home.

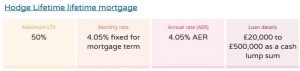

Hodge Mortgages Interest Rates

Interest rates on Hodge mortgages are competitive within the equity release market. They offer fixed-rate products, ensuring that borrowers have certainty about the amount they will have to repay each month or as a lump sum when the property is eventually sold.

Hodge Interest Only Mortgages

Hodge Lifetime also provides interest-only mortgage options. Similar to their RIO products, the borrower is required to pay only the interest part of the mortgage. This can significantly reduce the monthly financial burden for retirees with reduced incomes.

Hodge Lifetime Pensioner Mortgages

Pensioner mortgages are tailored specifically for retirees, often carrying features that accommodate the financial situations that pensioners may face, such as fixed incomes and the need for financial assistance in case of unexpected expenses.

Hodge Retirement Mortgages

Retirement mortgages are similar to pensioner mortgages but are designed with the broader retirement community in mind. These products might have benefits and options for retirees, including the flexibility to make ad-hoc repayments or downsizing protection.

Hodge Mortgages Retirement Interest Only Mortgages

These mortgages are a subset of retirement mortgages. They combine the features of retirement-specific financial needs with the payment structure of interest-only loans, allowing retirees to manage their monthly expenses more effectively.

Hodge Mortgages for the Over 50s, 55s, 60s, and Older

Hodge Lifetime has structured its products to address the needs of various age groups. Equity release products are generally available to those over 50, but the conditions and benefits vary greatly depending on the borrower’s age.

Hodge Later Life Mortgages

Later life mortgages are designed for the oldest segment of the homeowner population. Due to the shorter expected loan period, they often provide the most flexibility. These mortgages can be crucial tools for managing finances in the very later stages of life.

Hodge Lifetime Remortgage Over 60

For those over 60 looking to remortgage, Hodge Lifetime offers products that can replace existing mortgages, potentially providing better interest rates or more suitable terms for the individual’s current financial situation.

The Role of Lenders, Advisors, and Brokers

In the equity release landscape, lenders like Hodge Lifetime work alongside advisors and brokers to provide homeowners with the information and guidance they need to choose the right product. These professionals play a critical role in ensuring homeowners know the terms, risks, and benefits associated with equity release.

Equity Release for Older Borrowers with Varied Credit Histories

Equity release providers, including Hodge, often accommodate older borrowers with various credit histories. While credit checks are a standard part of the application process, the policies can be more lenient than those for standard mortgages, recognising the unique financial circumstances of older homeowners.

The Influence of Financial Experts

Figures such as Martin Lewis, known for his advice on money-saving strategies, have emphasised the importance of considering equity release carefully, recognising it as a significant financial decision. Potential borrowers must understand the long-term implications, especially as equity release can affect inheritance and state benefit entitlements.

Hodge Lifetime’s Position in the Equity Release Market

Hodge Lifetime continues to be a prominent player in the equity release market, with a reputation for innovation and customer-focused product development. Their range of equity release plans reflects an understanding of the financial needs of older homeowners, offering tailored solutions that can substantially improve retirees’ quality of life.

Any homeowner considering equity release must conduct thorough research, use tools such as equity release calculators, and seek advice from qualified professionals to ensure that they make the most informed decision possible. Hodge Lifetime’s product offerings and expert guidance can provide a viable financial pathway for many in their retirement years.